24+ co borrower on mortgage

Having a co-borrower is optional on a mortgage. Web A co-signer is someone who applies for a mortgage with you but who wont live in the home.

Loan Receipt 6 Examples Format Pdf Examples

For example when multiple people buy a home they can apply for a loan as co-borrowers.

. The lender will look at a co-signer or co-borrowers finances to determine if they can. Web Lets discuss having a co-borrower on a mortgage. Web The co-borrower takes on the same responsibilities as the primary borrower and therefore assumes the same risks.

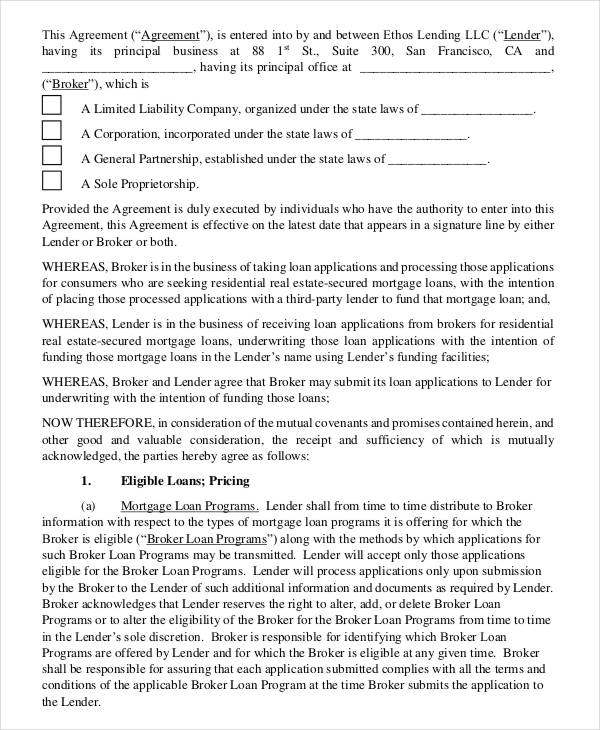

Web A co-borrower mortgage is one where the loan agreement is signed by two or occasionally more people who arent spouses or romantic partners. Depending on your agreement this. Web This is when a borrower takes their mortgage with them when they move to another house.

Home buyers can apply for a 100 USDA loan or 97 conventional mortgage without the help of a. Web Co-borrowers are two or more borrowers who are taking on the mortgage together and will have legal ownership of the property. Web While youll often hear co-borrower used to refer to anyone whos on the mortgage lenders make a few more distinctions within that term.

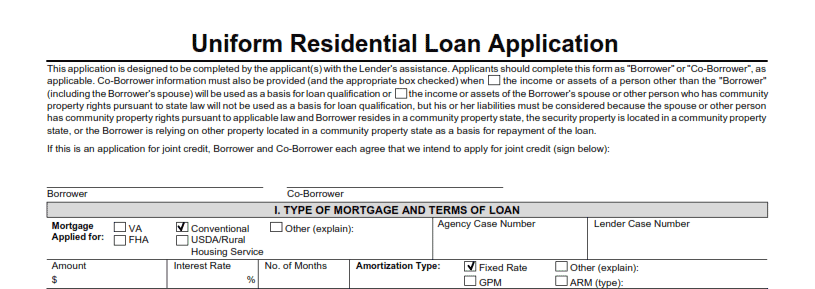

Approval is based on both borrowers. Co-Borrower Meaning A co-borrower is a person who applies for and shares liability of a loan with another. A co-borrower is someone who joins you the primary borrower in the mortgage application process.

Web What Is a Co-Borrower. This isnt something that all lenders allow but some modern mortgage. Web A borrower with a limited or spotty credit history who might otherwise be turned down for a loan might qualify when considered along with a co-applicant.

An example of this is two spouses. They go through the same. Web In both a co-owner and co-signer situation with a primary and secondary borrower both borrowers have the same obligations to the loan.

A co-borrower not only shares legal responsibility for your debt but also has legal rights to your asset unlike a co-signer. Web Low- and no-down payment mortgages may be an option. A cosigner is an individual who assumes the debt of.

A co-borrower on the mortgage is also a co-owner. Web A co-borrower is one of several primary borrowers. Their credentials are used in conjunction with.

Web Both co-signers and co-borrowers strengthen your mortgage application. To start a co. Web In real estate a co-borrower is someone who applies for a mortgage with you and shares in the loan repayment obligations.

As a mortgage co-borrower you will be charged late fees. Web A co-borrower is a spouse whose income and credit history are put on the loan application in addition to the primary borrower. In most cases the co-borrower and.

Web A co-borrower is someone who applies for a loan with another borrower and shares equal responsibility for the loans repayment. Refinancing does not end the extra co-borrowers. Web A co-borrower is an individual who jointly assumes the mortgage debt and generally lives in the home.

Web Mortgage Co-Borrower Seen with spouses and common-law partners a mortgage co-borrower buys into a percentage of the property. Web Co-borrowers to a reverse mortgage also need to meet credit score and income requirements as established by the reverse mortgage company. The co-signer strengthens your application by adding their income credit and.

Web A co-borrower or co-applicant is someone who applies and shares liability for repayment of a loan with another borrower. Taking a Co-Borrowers Name Off the Title. Web What is a co-borrower.

If two people are. Web Key Step.

Non Prime Select Guidelines Call Jesse B Lucero 702 551 3125

Delegated Underwriting Training Ppt Download

Non Prime Select Guidelines Call Jesse B Lucero 702 551 3125

Your Fico Score 10 And 10 T Explained

How To Claim Tax Benefits On Joint Home Loans

Jtl6gez7cboyqm

Should You Add A Co Borrower To Your Mortgage Bankrate

17 Best Personal Loan Lenders Loans In As Little As 24 Hrs

Pdf Non Financial Credit Information Sharing And Non Performing Loans An Analysis Using Doing Business Database

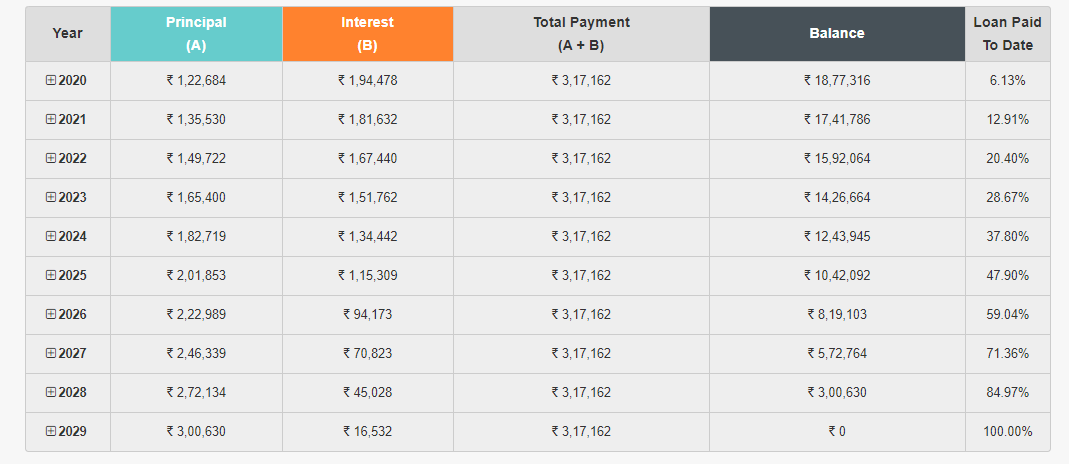

What Is Loan Repayment And Why Is It Important Moneytap

Free 6 Mortgage Quote Request Samples In Pdf

How To Apply For A Mortgage Loan Mortgage Application Process Grand Rapids Mortgage

Wholesale Lendz Financial

6 Mortgage Contract Templates Free Sample Example Format Download

17 Best Personal Loan Lenders Loans In As Little As 24 Hrs

Property Lokation Real Estate

The Risks You Take When You Co Sign A Loan For Someone Else Moneytap